How will the strength of the housing market fair after the transition from an economy which has been in several lock downs and starting to head back towards normality.

We are looking at several aspects of the property market, including its current situation and how the market is performing and has performed during this pandemic.

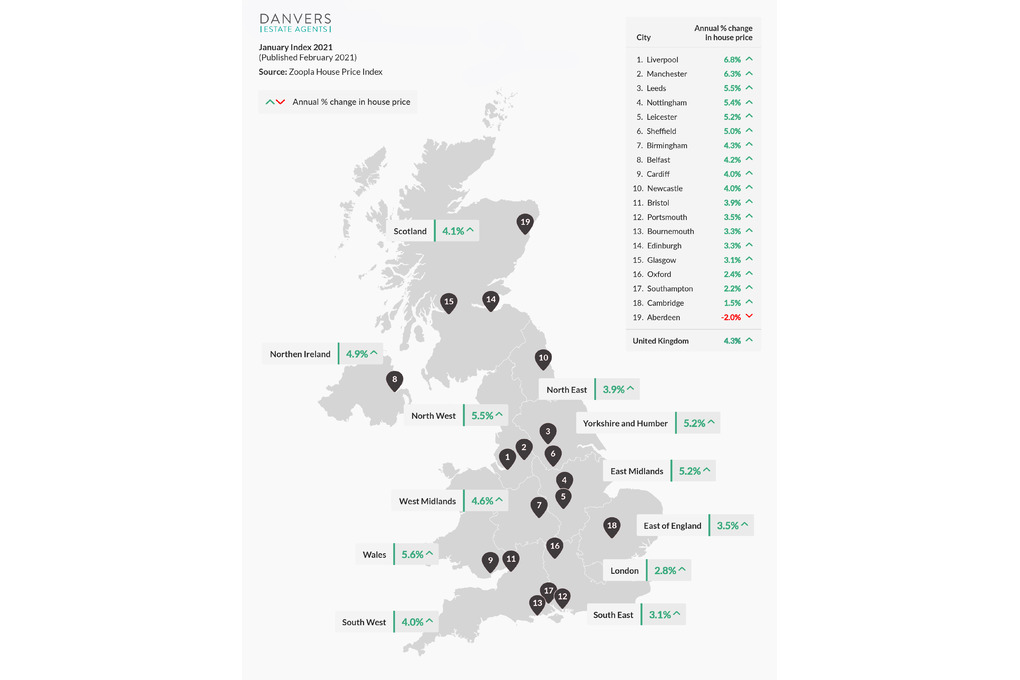

In January, house prices have edged up by 0.3%, meaning that the average annual price growth is expected to stand at 4.3%, which is the highest since April 2017.

Wales and the North of England have seen more significant growth in property prices, with Wales seeing house prices rise by as much as 5.6%, and the North of England by as much as 5,5%. London has also seen a price rise of 2.8% after having had a few dull years.

Manchester and Liverpool have seen the highest house price rise over the past 12 months with annual growth of 6.3% and 6.8%, respectively.

According to the House Price Index, the Midlands has remained steady and keeps showing strong signs of consistency, with Leicester seeing annual growth of 5.2% and being in the top 5 cities.

Buyer demand remains strong since the first announcement of the Stamp Duty Holiday. With the recent Stamp Duty Holiday extension announcement, buyer demand is expected to stay strong.

Sellers who were uncertain whether to sell or not have started to list their properties, adding much-needed stock to the property market. With this new stock, buyer demand is still surpassing available stock, continuing to push property prices up.

With the housing market remaining open, including a wide range of associated businesses, including agents, solicitors, movers, fitters, and so on, has meant that after the country's initial six weeks in a national lockdown, the property market has been able to carry on trading.

Although delays in conveyancing processes and mortgage applications have impacted the sales process, more and more businesses in this sector have been employing new people to help with this thriving demand.

Although the demand after the first national lockdown has been from existing homeowners who have been evaluating their living arrangements, First-Time Buyers have started to come back to the market during the last three months of 2020.

Existing homeowners have surpassed First-Time Buyers in sales during 2020 due to lenders tightening the lending criteria and removing many mortgage products with a lower LTV (Loan-To-Value). However, since September 2020, lenders started to bring back mortgage products with a lower LTV to First-Time Buyers, who previously dominated the property market for the past ten years prior to the first national lockdown.

After the Stamp Duty Holiday extension, the government's announcement of the new 95% mortgage and the addition of new mortgage products by lenders for buyers with smaller deposits, First-Time Buyers look likely to return to the market. With the pent-up demand from buyers, property prices are most likely to increase due to the lack of available properties to meet buyer demand across the board.

Stamp Duty

The Stamp Duty Holiday is still leading the way as buyers want to maximise savings for this tax-free threshold.

The extension means that buyers will not have to pay stamp duty on the first £500,000, providing they complete before June 30th.

From the July 1st until September 30th, stamp duty will not be charged on the first £250,000, providing completion is done before September 30th.

On October 1st, the nil rate band will fall back to £125,00.

The stamp duty holiday extension has been welcomed by many buyers and industry leaders, who have been pushing for this extension since the start of the year.

Many were uncertain if they could complete on time if the previous delaine still presided, have had a sigh of relief after the Chancellor's announcement.

The holiday extension means nine out of 10 people buying a property will not have to pay stamp duty, saving them an average of £4,500 each and a maximum of £15,000 for those purchasing a home costing £500,000.

Many people looking to benefit from this once in a lifetime tax break after re-evaluating their living situation due to the several national lockdowns and movement restrictions since the pandemic began, has meant that existing homeowners have overtaken first-time buyers who have been dominating the property market prior to the first national lockdown.

Property transactions have also taken longer than usual due to the spike in property sales currently taking place. It's estimated that around 70,000 people were close to missing the March 31st deadline if this was still the case.

Once the stamp duty holiday ends on June 30th, there will be an interim period until September 30th when the tax-free threshold will fall to £250,000.

The tapering move means that nearly half of housing sales in England will be free of stamp duty. Last year, some 46% of all home sales were for properties of up to £250,000.

If you are looking to buy or sell a property, speak with one of our property experts today by calling us on 0116 275 8888!

#StampDutyHoliday #LeicesterPropertyMarket #PropertyPriceIndex #StampDutyHoliday #Danvers

Like

Like